For use at and after Jan 01, 2024 (Last updated Dec 24, 2023)

NOTE

Carryover from 2020+ are:

The 2020+ W4 form is redesigned to indicate marital status, credits for dependents, and adjustments to withholding. The old W4 is still valid, and only new employees need to use the new W4's, or employees who change their tax status.

NOTE - You may print the new W4 form from the Payroll Menu. See the 'Form W4 View/Print' button.

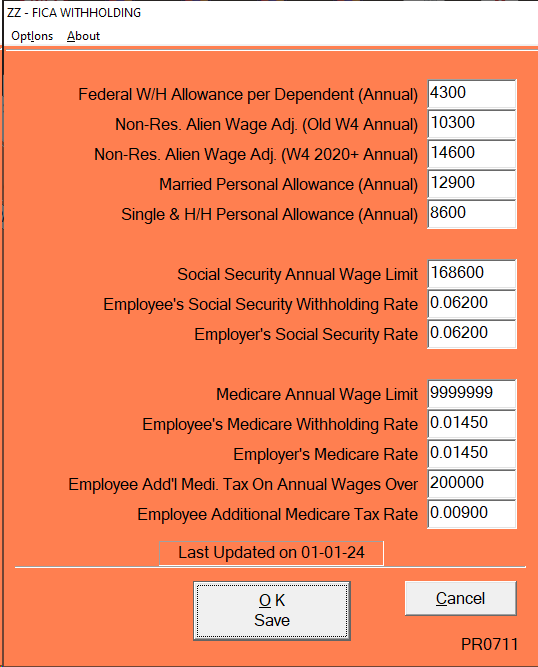

The ZZ tables have additional info for standard personal allowances, resident alien adjustments, and medicare tax for wages over $200,000.

The US tables now include a Head of Household table. Also a seceond federal table 'UA' containing single, married, and head of household sections (see below) is required. It is used if step 2 on the new 2020+ W4 is checked (2 jobs).

If you have not done so since the above date, you should Download/Install Updates for

your Greux programs (File | Utilities | Download Updates). Then for every company that has a Payroll, get

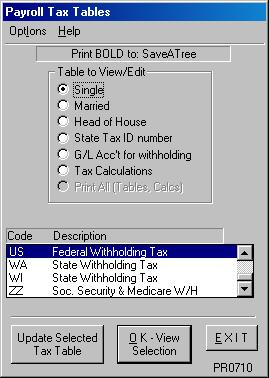

to the P/R Configuration/Tax tables window (shown below).

Select US and click on the

"Update selected tax table" button. This will update the ZZ and UA tables also.

If you need tables for your State, then select your state and click "Update...". If your state is not there, contact KISS Development.

This is all you need to do to get the latest tables.

These Tax Table Masters are always available with the Payroll module.

Reference: Circular E for 2024, see

IRS Publication 15 (Circular E)

Reference: Publication 15-T for 2024, see

IRS Publication 15-T Tax Tables and Calculation (Annual)

Listed below are the withhholding tables effective January 2024. If you have run several payrolls using the old US single and married tables, that's OK.

2024 PAYROLL WITHHOLDING TAX TABLES

CLASSIFICATION: US - HEAD OF HOUSEHOLD

SEQ. GROSS WAGE DOLLARS DATE

NO. LIMIT OF TAX RATE STATUS ENTERED

01 13,300.00 0.00 0.00000 ACTIVE 01/01/24

02 29,850.00 0.00 0.10000 ACTIVE 01/01/24

03 76,400.00 1,655.00 0.12000 ACTIVE 01/01/24

04 113,800.00 7,241.00 0.22000 ACTIVE 01/01/24

05 205,250.00 15,469.00 0.24000 ACTIVE 01/01/24

06 257,000.00 37,417.00 0.32000 ACTIVE 01/01/24

07 622,650.00 53,977.00 0.35000 ACTIVE 01/01/24

08 99,999,999.99 181,954.50 0.37000 ACTIVE 01/01/24

CLASSIFICATION: US - MARRIED

SEQ. GROSS WAGE DOLLARS DATE

NO. LIMIT OF TAX RATE STATUS ENTERED

01 16,300.00 0.00 0.00000 ACTIVE 01/01/24

02 39,500.00 0.00 0.10000 ACTIVE 01/01/24

03 110,600.00 2,320.00 0.12000 ACTIVE 01/01/24

04 217,350.00 10,852.00 0.22000 ACTIVE 01/01/24

05 400,200.00 34,337.00 0.24000 ACTIVE 01/01/24

06 503,750.00 78,221.00 0.32000 ACTIVE 01/01/24

07 747,500.00 111,357.00 0.35000 ACTIVE 01/01/24

08 99,999,999.99 196,669.50 0.37000 ACTIVE 01/01/24

CLASSIFICATION: US - SINGLE

SEQ. GROSS WAGE DOLLARS DATE

NO. LIMIT OF TAX RATE STATUS ENTERED

01 6,000.00 0.00 0.00000 ACTIVE 01/01/24

02 17,600.00 0.00 0.10000 ACTIVE 01/01/24

03 53,150.00 1,160.00 0.12000 ACTIVE 01/01/24

04 106,525.00 5,426.00 0.22000 ACTIVE 01/01/24

05 197,950.00 17,168.50 0.24000 ACTIVE 01/01/24

06 249,725.00 39,110.50 0.32000 ACTIVE 01/01/24

07 615,350.00 55,678.50 0.35000 ACTIVE 01/01/24

08 99,999,999.99 183,647.25 0.37000 ACTIVE 01/01/24

The following UA table is used if step 2 of the new 2020+ W4 is checked

CLASSIFICATION: UA - HEAD OF HOUSEHOLD

SEQ. GROSS WAGE DOLLARS DATE

NO. LIMIT OF TAX RATE STATUS ENTERED

01 10,950.00 0.00 0.00000 ACTIVE 01/01/24

02 19,225.00 0.00 0.10000 ACTIVE 01/01/24

03 42,500.00 827.50 0.12000 ACTIVE 01/01/24

04 61,200.00 3,620.50 0.22000 ACTIVE 01/01/24

05 106,925.00 7,734.50 0.24000 ACTIVE 01/01/24

06 132,800.00 18,708.50 0.32000 ACTIVE 01/01/24

07 315,625.00 26,988.50 0.35000 ACTIVE 01/01/24

08 99,999,999.00 90,977.25 0.37000 ACTIVE 01/01/24

CLASSIFICATION: UA - MARRIED

SEQ. GROSS WAGE DOLLARS DATE

NO. LIMIT OF TAX RATE STATUS ENTERED

01 14,600.00 0.00 0.00000 ACTIVE 01/01/24

02 26,200.00 0.00 0.10000 ACTIVE 01/01/24

03 61,750.00 1,160.00 0.12000 ACTIVE 01/01/24

04 115,125.00 5,426.00 0.22000 ACTIVE 01/01/24

05 206,550.00 17,168.50 0.24000 ACTIVE 01/01/24

06 258,325.00 39,110.50 0.32000 ACTIVE 01/01/24

07 380,200.00 65,678.50 0.35000 ACTIVE 01/01/24

08 99,999,999.00 98,334.75 0.37000 ACTIVE 01/01/24

CLASSIFICATION: UA - SINGLE

SEQ. GROSS WAGE DOLLARS DATE

NO. LIMIT OF TAX RATE STATUS ENTERED

01 7,300.00 0.00 0.00000 ACTIVE 01/01/24

02 13,100.00 0.00 0.10000 ACTIVE 01/01/24

03 30,875.00 580.00 0.12000 ACTIVE 01/01/24

04 57,563.00 2,713.00 0.22000 ACTIVE 01/01/24

05 103,275.00 8,584.25 0.24000 ACTIVE 01/01/24

06 129,163.00 19,555.25 0.32000 ACTIVE 01/01/24

07 311,975.00 27,839.25 0.35000 ACTIVE 01/01/24

08 99,999,999.00 91,823.63 0.37000 ACTIVE 01/01/24

If the tax rates for your state have changed, let us know. We do not monitor all state withholdings rates. That is your responsibility as an employer. However if yours did change and we don't have the new rate, we will ask you to send us a copy of the state's computer formula (annualized). We will update the calculations and include in the master tables used above.